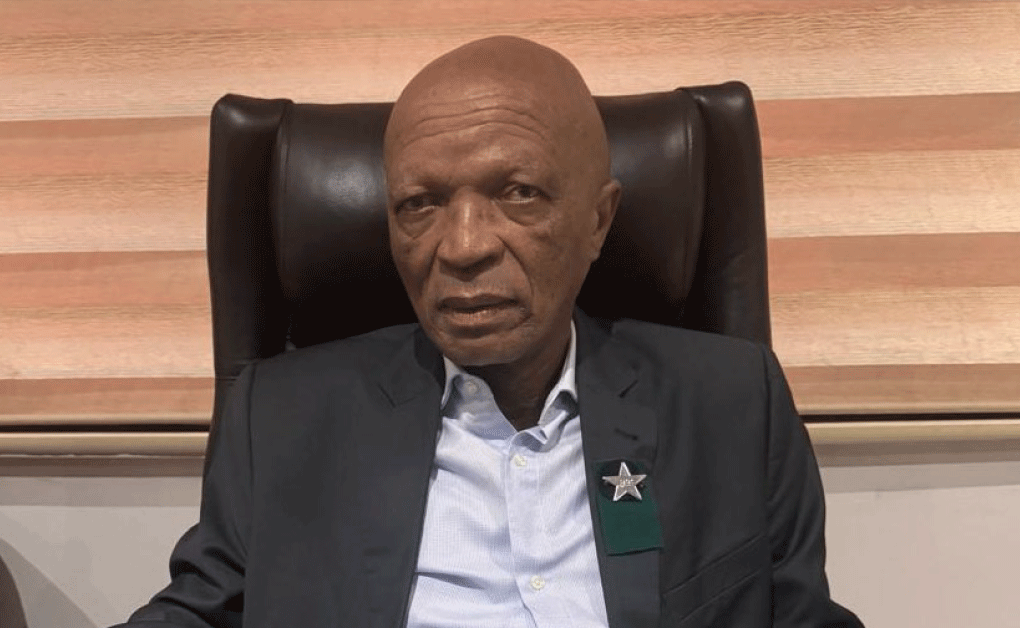

The R408-million budgetary allocation to the taxi industry, announced by Finance Minister Enoch Godongwana, is facing scrutiny from Mmusi Maimane, leader of Build One South Africa (BOSA).

The allocation, detailed in Godongwana’s revised 2025/2026 National Budget Speech delivered on 12 March 2025, drew significant backlash as Parliament prepared to vote on the national budget early this month.

Described as a “once-off gratuity,” the grant has sparked criticism from stakeholders, including BOSA, which is demanding clarity from Transport Minister Barbara Creecy.

Maimane’s office submitted parliamentary questions seeking explanations behind the justification of the R408-million gratuity to the taxi operators.

BOSA spokesperson Roger Solomon criticised the decision, accusing the taxi industry of systemic tax non-compliance: “We have to ask for a multibillion-rand industry that pays zero tax, this allocation is highly questionable.

“Taxpayers deserve to know whether this R408-million payment is a necessary intervention or simply another opaque expenditure benefitting a politically connected sector.”

The taxi industry, however, has vehemently rejected BOSA’s claims, accusing Maimane’s party of political grandstanding.

SANTACO KZN Office Manager Mr Sifiso Shangase argued, “politicians must be educated about the taxi industry’s tax status as they may end up disseminating wrong messages to the members of public.

Shangase challenged BOSA’s assertions: “How does Roger Solomon know that individual taxi operators don’t pay tax?

“Such comments border on ignorance.

“As per law, the tax details of individual taxpayers or companies are private and confidential, but I can confirm that taxi operators pay their taxes.

“The problem is that those who accuse taxi operators of being non tax compliant choose to ignore the taxable expenses we incur when we run our businesses and instead concentrate only in the income the industry generates.

“They need to do a thorough assessment of the taxi industry to determine as to whether those that they say don’t pay tax meet the SARS tax threshold or specific tax bracket.

“Again, we encourage our members to be in good standing with SARS as this is also a requirement to have SARS PIN to apply for an operating license. Workshops are also conducted to educate taxi operators about the importance of paying tax,” he said.

Midday Mali, SANTACO Gauteng chairperson, echoes Shangase:

“Those that claims that taxi operators don’t pay taxi are misinformed and need to be educated themselves about the taxi industry and SARS processes.

“When operators apply for operating licenses to the regulator, they are required to produce a tax clearance certificate issued by SARS,” Mali clarified.

He added that taxi operators pay all forms of taxes including declaring their personal income, and that they deserve the R408 million gratuity as budgeted for them.

“Taxi operators when they buy cars, they pay VAT that they don’t even claim including declaring their personal income to the receiver. In terms of VAT this is the area that the government should assist us to claim back those billions we pay dealerships when we buy cars.

“We deserve every penny of the R408 million grant,” he said.