Taxi associations have rallied in support of Ithala Bank to prevent its complete closure.

This follows the KwaZulu-Natal legislature’s Economic Development and Tourism Portfolio Committee’s decision to back Ithala Bank in its legal battle against liquidation, urging national parliament to intervene.

“The Prudential Authority’s decision to pursue liquidation undermines these efforts and the broader developmental role Ithala plays in the province,” the committee said.

“The aim of the intervention is to reach a resolution that protects the businesses and people of KwaZulu- Natal who rely on Ithala Bank for their financial and developmental needs.”

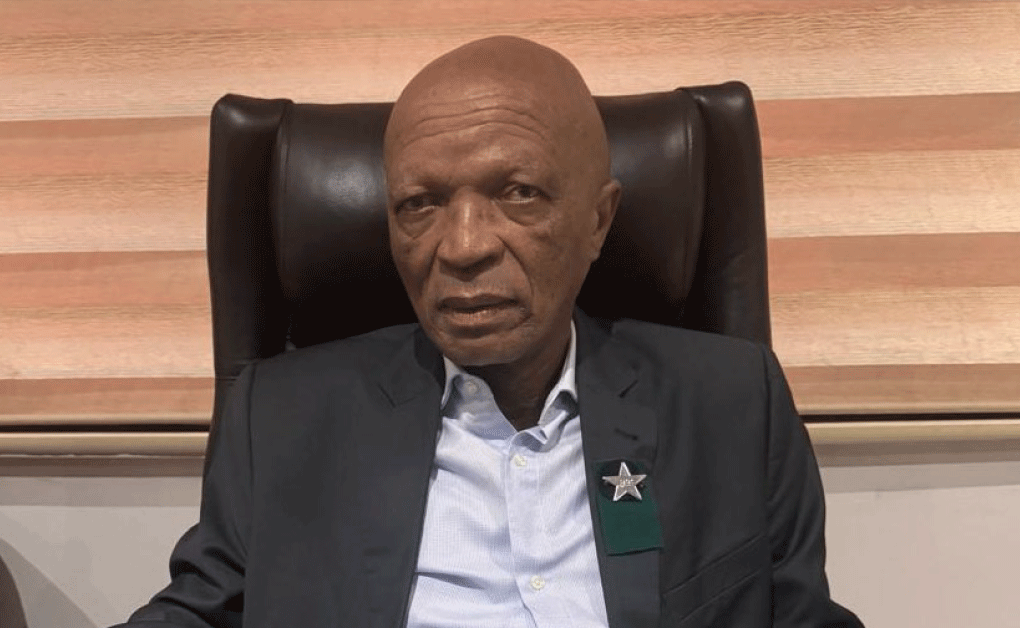

Nkosinathi Nala, Public Relations Officer of the Osizweni Taxi Association, expressed concern over the bank’s pending liquidation.

“I have a bank account at Ithala, and so do many taxi operators I know personally who are also customers of the bank. I received an SMS message saying I cannot withdraw and deposit. There is one taxi owner I know with R1 million deposited and others who bought vehicles financed by Ithala,” Nala revealed.

He explained that many taxi operators preferred Ithala due to its competitive interest rates for vehicle financing.

“Ithala offered taxi operators favourable financing terms including lower interest rates. We were happy that Ithala had a good relationship with the taxi industry including attending taxi events to speak to our members about different services and products they were offering our members.

“If Ithala financed for example a Toyota Quantum 16-seater, your total costs of ownership would not exceed R1 million compared to other banks or finance institutions,” he said.

Nala attributed Ithala’s challenges to politics and poor management.

“We are where we are because of politicians and management of the bank including the Reserve Bank itself,” he said.

He emphasised the urgency of resolving Ithala’s challenges to restore trust among depositors.

“The bank’s existential challenges must be resolved as soon as possible for us to resume with our normal lives. This closure has made the bank highrisk— no depositor is going to put their money again in the bank that they don’t trust if this matter isn’t resolved soon.

“Even if it reopens tomorrow, there will be a bank run. That means the bank will collapse as depositors rush to withdraw their savings and investments,” he warned.

Nala highlighted Ithala Bank’s significant role in addressing the needs of local communities in KwaZulu-Natal.

“The bank has a long history in the banking sector. It is known for supporting those who were considered unbankable, providing access to loans, accepting deposits, and offering financial services for years without issues,” he said.

He reminisced about the bank’s role during Apartheid when it filled the gap left by other banks that excluded black customers.

“Local businesses grew with Ithala. The bank spoke our language and remains part of our economic heritage. Its services were good, affordable, and accommodating. During Apartheid, when banks did not serve black customers, Ithala was there for us,” he added.

The Prudential Authority, a regulatory body under the South African Reserve Bank, argues that the liquidation is in the best interests of Ithala’s 257,000 depositors. They believe that a liquidator can use insolvency legislation to recover and distribute funds.

However, Nala strongly disagreed. “There are many people, including stokvels and social clubs, who have invested in Ithala. You cannot liquidate a business that does not owe anyone. Maybe its only fault is being a state bank in the province, as we understand state banks are supposed to be national. But the Postbank is also struggling— where do we go now that Ithala is closed?” he asked.

“This is more about politics than what is being said about the bank’s non-compliance. Ithala has been operating since 1958 without problems,” he concluded.